Decentralized Finance: present and future: Difference between revisions

No edit summary |

|||

| (75 intermediate revisions by 4 users not shown) | |||

| Line 6: | Line 6: | ||

===Bitcoin=== | ===Bitcoin=== | ||

Created in 2009, Bitcoin is the first decentralized cryptocurrency that runs on a peer to peer network built on blockchain technology. The creator of bitcoin uses the pseudonym Satoshi Nakamoto, but their real identity is unknown at this time. | |||

Bitcoins are created by a process called “Bitcoin mining”, which essentially means that computers solve algorithms and receive rewards in Bitcoin for their work. This process is used to check and verify transactions on the network. The algorithms are “blocks”, that the computers mine and when the block is completely “mined”, the reward is given. | |||

The first block mined contained the message “The Times Jan/03/2009 Chancellor on brink of second bailout for banks.” This indicates that the cryptocurrency was most probably created as a response to the failure of conventional currencies during the 2008 crisis and to give people control over their own money, rather than having to trust a third party like a bank.<ref>James. “The History of Bitcoin: A Complete Timeline of the Start of Web3.” History Cooperative, 6 Feb. 2022, historycooperative.org/the-history-of-bitcoin. Accessed 20.03.2022</ref> | |||

===Ethereum=== | ===Ethereum=== | ||

| Line 11: | Line 16: | ||

====Proof of Work vs Proof of Stake==== | ====Proof of Work vs Proof of Stake==== | ||

When it was first developed, the security of Ethereum blockchain was based on proof-of-work.This concept is relied upon to make any sort of attack and manipulation on the chain extremely difficult, which is needed to ensure the availability of the network, as well as to prevent mishaps like double spending | When it was first developed, the security of Ethereum blockchain was based on proof-of-work.This concept is relied upon to make any sort of attack and manipulation on the chain extremely difficult, which is needed to ensure the availability of the network, as well as to prevent mishaps like double spending | ||

==== | ====Proof of Work==== | ||

Even though proof of work is a term popularized by Bitcoin(whose security is also based on this concept), it was actually coined in the early 2000s. Later as it got adapted as the security guarantee of most cryptocurrencies, it started to play a more important role in most tech savvy consumers’ lives. | Even though proof of work is a term popularized by Bitcoin(whose security is also based on this concept), it was actually coined in the early 2000s. Later as it got adapted as the security guarantee of most cryptocurrencies, it started to play a more important role in most tech savvy consumers’ lives. | ||

To understand how proof of work works, we first need to understand what the “work” in “proof of work” is. Here, work refers to the work done by Etherum miners to validate and add a new block to the blockchain, in order to enable new transactions to take place. Network security relies on the fact that the computations done by the miners in order to add a new block to the chain are very labor-intensive and hard to replicate, yet they are extremely easy to be verified by anyone who wishes to do so.Miners are incentivised by a monetary price in the form of blockchain’s native token, which is given to whoever is able to solve the problem(find the nonce of the transaction) first. However this computationally intensive process also means miners employ very powerful equipment that consumes high amounts of energy. A single Etherum transaction is said to use 262 kWh energy, which is comparable to the amount used by a US household in 5 days. | To understand how proof of work works, we first need to understand what the “work” in “proof of work” is. Here, work refers to the work done by Etherum miners to validate and add a new block to the blockchain, in order to enable new transactions to take place. Network security relies on the fact that the computations done by the miners in order to add a new block to the chain are very labor-intensive and hard to replicate, yet they are extremely easy to be verified by anyone who wishes to do so.Miners are incentivised by a monetary price in the form of blockchain’s native token, which is given to whoever is able to solve the problem(find the nonce of the transaction) first. However this computationally intensive process also means miners employ very powerful equipment that consumes high amounts of energy. A single Etherum transaction is said to use 262 kWh energy, which is comparable to the amount used by a US household in 5 days. | ||

There are many different reasons for the switch from Proof of Work to Proof of Stake, but some of the most common are listed below. | |||

There are many different reasons for the switch from Proof of Work to Proof of Stake, but | =====The environmental cost===== | ||

=====The environmental cost | As mentioned above, the environmental cost of mining seems high to many people, though usually this is not based on a decision made by comparing ETH mining process to other financial transactions, some a lot more meaningless, like high frequency stock trading executed every day in Wall Street. Yet regardless of how fair or an unfair comparison is made, it is obviously a good idea to make sure the future of finance is constructed in a more sustainable way. Hence this is one of the aims of switching from PoW to PoS, which will remove the incentive for doing the calculations necessary to add new blocks to the chain as fast as possible, thus in effect lowering energy consumption of miners<ref>Editorial Staff. “Why Is Ethereum Switching From Proof of Work to Proof of Stake?” Business Magazine - Ideas and News for Entrepreneurs, 15 June 2021, www.businessmagazine.org/why-is-ethereum-switching-from-proof-of-work-to-proof-of-stake-15620.</ref> | ||

As mentioned above, the environmental cost of mining seems high to many people, though usually this is not based on a decision made by comparing ETH mining process to other financial transactions, some a lot more meaningless, like high frequency stock trading executed every day in Wall Street. Yet regardless of how fair or an unfair comparison is made, it is obviously a good idea to make sure the future of finance is constructed in a more sustainable way. Hence this is one of the aims of switching from PoW to PoS, which will remove the incentive for doing the calculations necessary to add new blocks to the chain as fast as possible, thus in effect lowering energy consumption of miners | =====Monopolization of the Network===== | ||

=====Monopolization of the Network | As mentioned above, the safety and longevity of Ethereum blockchain depends on solving the computational puzzles presented with every transaction as fast as possible. And in order to make sure there are people willing to do this job so that the chain remains online, a monetary incentive is presented to solvers. This financial gain quickly drew the attention of entrepreneurs, especially people who had access to cheap electricity. Slowly, a whole industry developed around Ethereum mining, and the imbalance in computational power of miners meant small-time miners began seeing considerable decreases in their rewards. Eventually, big companies took over almost all of the mining, leading to a highly un-decentralized system, which goes contrary to the very spirit of the development of most blockchain technologies, With a switch to PoS, the hope is a shift to a more egalitarian system where not only mining-whales but also small shrimp who just want to partake in the blockchain have some say will be achieved.<ref>DailyCoin. “What Happens to ETH If It Becomes PoS?” DailyCoin.Com, 5 July 2021, dailycoin.com/what-happens-to-eth-if-it-becomes-pos.</ref> | ||

As mentioned above, the safety and longevity of Ethereum blockchain depends on solving the computational puzzles presented with every transaction as fast as possible. And in order to make sure there are people willing to do this job so that the chain remains online, a monetary incentive is presented to solvers. This financial gain quickly drew the attention of entrepreneurs, especially people who had access to cheap electricity. Slowly, a whole industry developed around Ethereum mining, and the imbalance in computational power of miners meant small-time miners began seeing considerable decreases in their rewards. Eventually, big companies took over almost all of the mining, leading to a highly un-decentralized system, which goes contrary to the very spirit of the development of most blockchain technologies, With a switch to PoS, the hope is a shift to a more egalitarian system where not only mining-whales but also small shrimp who just want to partake in the blockchain have some say will be achieved. | ====Proof of Stake==== | ||

==== | |||

Proof of stake is a consensus mechanism where the miners, who are now called “validators” are chosen randomly by an algorithm-though it is important to note that this algorithm makes its selection based on the amount of holdings every validator has, so whoever has more ETH has a higher chance of being picked, currently this bar is set at 32 ETH, which is worth around $100,000 at the time of writing, thus removing the need to compete against other validators and getting rid of the need to employ very fast machines that consume exorbitant amounts of energy.The switch is also supposed to make Ethereum blockchain more scalable, allegedly allowing for up to 100,000 times more transactions to be validated per second. | Proof of stake is a consensus mechanism where the miners, who are now called “validators” are chosen randomly by an algorithm-though it is important to note that this algorithm makes its selection based on the amount of holdings every validator has, so whoever has more ETH has a higher chance of being picked, currently this bar is set at 32 ETH, which is worth around $100,000 at the time of writing, thus removing the need to compete against other validators and getting rid of the need to employ very fast machines that consume exorbitant amounts of energy.The switch is also supposed to make Ethereum blockchain more scalable, allegedly allowing for up to 100,000 times more transactions to be validated per second. | ||

===Monero=== | ===Monero=== | ||

Even though most people who don’t have in depth knowledge about cryptocurrencies think they are anonymous, most cryptocurrencies are technically pseudo-anonymous at best(the at best part being due to the very common use of centralized exchanges, which are regulated by governments right ow and are subject to KYC-Know Your Customer- and anti-money laundering laws). They do allow transacting entities to be traced using their wallet addresses, and through these addresses anyone can get the full transaction history belonging to that address. So even if linking an address to a person isn’t something your average Joe is capable of, for a dedicated tech-savvy person, and for any government that has reign over the centralized cryptocurrency exchanges, it isn’t as difficult as some people make it out to be. | |||

This is where Monero comes in. Monero, known to traders as XMR, is a fully anonymous, decentralized cryptocurrency. It has the thid largest developer community behind it, after BTC and ETH, and attracts a lot of attention from privacy activists and cypherpunks, as well as governments and their taxation departments, like America’s Internal Revenue Service(IRS), who is offering bounties to anyone who is able to develop monero tracking technologies. | |||

====Privacy==== | |||

Even though Monero is open source and uses a public distributed ledger system, allowing anyone interested to observe the transactions, these observers’ capabilities are reduced significantly compared to pseudo-anonymous blockchains like Bitcoin and Ether | Even though Monero is open source and uses a public distributed ledger system, allowing anyone interested to observe the transactions, these observers’ capabilities are reduced significantly compared to pseudo-anonymous blockchains like Bitcoin and Ether | ||

XMR doesn’t release any information about the monetary amount of the transactions | XMR doesn’t release any information about the monetary amount of the transactions | ||

It doesn’t release any information about the status of funds belonging to a certain address, whether they have been spent, transferred or not. | It doesn’t release any information about the status of funds belonging to a certain address, whether they have been spent, transferred or not. | ||

The network also supports I2P(Invisible NetworkProject) that is an anonymous network layer(like Tor, but better according to some) that doesn’t even reveal the information that any transaction done on XMR is actually done on XMR. | The network also supports I2P(Invisible NetworkProject) that is an anonymous network layer(like Tor, but better according to some) that doesn’t even reveal the information that any transaction done on XMR is actually done on XMR. | ||

====Sea level==== | |||

At a very basic level, we can describe this process as a masked dance party(courtesy of www.monero.how), where everyone is wearing masks of other participants, and all the attendees have multiple masks. So nobody knows who you actually dance with, many other people can claim to have danced with “you” at different times, or even at the same time, and in the end everyone will have danced with everyone. | |||

This analogy also explains why Monero enforces intractability for all transactions. If there were only three people on the dance floor, figuring out who is who would be a lot easier. Monero widens this pool by requiring everyone to remain anonymous. | This analogy also explains why Monero enforces intractability for all transactions. If there were only three people on the dance floor, figuring out who is who would be a lot easier. Monero widens this pool by requiring everyone to remain anonymous. | ||

====Deeper Level==== | |||

Monero provides anonymity using multiple different techniques. The most important ones are: using “stealth” addresses, bulletproofs, Dandelion++ | Monero provides anonymity using multiple different techniques. The most important ones are: using “stealth” addresses, bulletproofs, Dandelion++ | ||

====Stealth Addresses==== | |||

Stealth addresses are created by the sender every time a transaction is done. They are randomly generated, so observers aren’t able to connect transactions done by the same user to that person. <ref>“What Is a Stealth Address?” Investopedia, 25 Feb. 2022, www.investopedia.com/terms/s/stealth-address-cryptocurrency.asp.</ref> | |||

The sender can use their private viewing key to see the record of all their transactions, but anyone who doesn’t have these keys isn’t able to track the transactions done by the person. | The sender can use their private viewing key to see the record of all their transactions, but anyone who doesn’t have these keys isn’t able to track the transactions done by the person. | ||

====Bulletproofs==== | |||

At first, Monero employed ring signatures and RingCT to obscure the amount of funds being transacted. Ring signatures create digital signatures that can be validated by anyone who has access to the public keys of the group members, but no information about which member of the group created the signature during this process. The original papers describe a scheme based on RSA signatures. | |||

Monero specifically employed “mixins” from previous transactions to obfuscate the sender’s address. First there was no lower limit, but as it was later realized this created a huge threat vector, a minimum of seven decoy signatures requirement was added. But a big downside of RingCT scheme was its huge size overhead. So a switch to “bulletproofs” was made | |||

Bulletproofs are based on “Non-Interactive Zero Knowledge Proof”(NZIP), which basically allows someone to commit a statement without revealing to the verifier what that statement is. For example if you and your friend are playing a guessing game where you tried to guess a number your friend randomly picked, your friend could commit this number with a zero knowledge proof commitment so that you wouldn’t know what it was until it was revealed, but your friend would have no way of claiming it was some other number either. These bulletproofs don’t require a trusted setup, hence lowering the size requirements and potentially allowing for additional security implementations to be made.<ref>Nuzzi, Lucas. “Monero Becomes Bulletproof - Digital Asset Research.” Medium, 19 Oct. 2018, medium.com/digitalassetresearch/monero-becomes-bulletproof-f98c6408babf.</ref> | |||

==Stability of Cryptocurrency== | ==Stability of Cryptocurrency== | ||

| Line 58: | Line 53: | ||

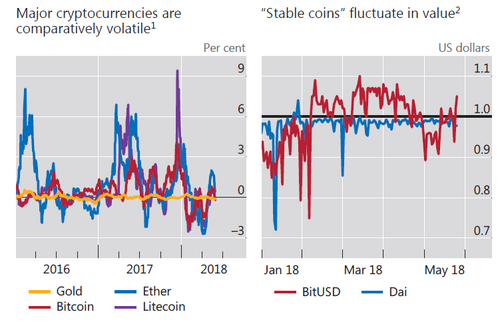

[[File:Bis.png|500px|thumb|right|Stability of currencies<ref>V. Cryptocurrencies: looking beyond the hype https://www.bis.org/publ/arpdf/ar2018e5.pdf, pag 101, graph V.6 | 2018. Accessed 26 Apr 2022</ref>]] | [[File:Bis.png|500px|thumb|right|Stability of currencies<ref>V. Cryptocurrencies: looking beyond the hype https://www.bis.org/publ/arpdf/ar2018e5.pdf, pag 101, graph V.6 | 2018. Accessed 26 Apr 2022</ref>]] | ||

Before 1971, the value of currency (and its consequent stability) was tightly linked to gold, insofar as the currency was merely a standby for the literal amount of gold that could be exchanged for that banknote of coin. | Before 1971, the value of currency (and its consequent stability) was tightly linked to gold, insofar as the currency was merely a standby for the literal amount of gold that could be exchanged for that banknote of coin. | ||

The power of this transition from amounts of stuff (goods, cattle, gold, ect.) to a “paper” that guaranteed the same values exchanged was understood and already implemented in early-developing banking systems. The advantage is clear: less need to move goods around for every transaction; faster and more agile trading. | The power of this transition from amounts of stuff (goods, cattle, gold, ect.) to a “paper” that guaranteed the same values exchanged was understood and already implemented in early-developing banking systems. The advantage is clear: less need to move goods around for every transaction; faster and more agile trading. | ||

This whole system relies, however, on the possibility of banks to exchange the banknote for gold, and vice versa. The bank grants for the amount of gold in your stead. | This whole system relies, however, on the possibility of banks to exchange the banknote for gold, and vice versa. The bank grants for the amount of gold in your stead. | ||

After 1971, however, the literal connection (and possible exchange) from banknote to gold was severed. Traditional currency is now referred to as fiat<ref>N. Gregory Mankiw (2014). Principles of Economics. p. 220. ISBN 978-1-285-16592-9. fiat money: money without intrinsic value that is used as money because of government decree</ref> (latin for “it will be”). | After 1971, however, the literal connection (and possible exchange) from banknote to gold was severed. Traditional currency is now referred to as fiat<ref>N. Gregory Mankiw (2014). Principles of Economics. p. 220. ISBN 978-1-285-16592-9. fiat money: money without intrinsic value that is used as money because of government decree</ref> (latin for “it will be”). | ||

This fiat currency is now issued by a central government, and the same government grants for its value. | This fiat currency is now issued by a central government, and the same government grants for its value. | ||

When managed by strong governments, fiat currency is generally stable. | When managed by strong governments, fiat currency is generally stable. | ||

Moreover, governments generally offer some form of asset protection, and enact laws that protect consumers against digital fraud or theft, which makes it easier to recover lost funds. | Moreover, governments generally offer some form of asset protection, and enact laws that protect consumers against digital fraud or theft, which makes it easier to recover lost funds. | ||

Unfortunately, the centralisation also brings many problems, an obvious one being inflation. Moreover, having to rely on intermediaries, significant charges are issued to users. | Unfortunately, the centralisation also brings many problems, an obvious one being inflation. Moreover, having to rely on intermediaries, significant charges are issued to users. | ||

Absence of intermediaries is indeed one of the more appealing characteristics of crypto currencies, which enables the consumers to lower the fees (transactions, | |||

Absence of intermediaries is indeed one of the more appealing characteristics of crypto currencies, which enables the consumers to lower the fees (transactions, etc.) and costs of account maintenance, and take more control over their finances and privacy. | |||

However, the same anonymity properties can attract money launderers and other criminals, who can use them not to be tracked back to a fraud or a cyber attack. | However, the same anonymity properties can attract money launderers and other criminals, who can use them not to be tracked back to a fraud or a cyber attack. | ||

These are all factors that contribute in an indirect manner to the stability of crypto currencies; however, the lack of a regulated body that can grant asset protection or insurance is the main cause of instability. | These are all factors that contribute in an indirect manner to the stability of crypto currencies; however, the lack of a regulated body that can grant asset protection or insurance is the main cause of instability. | ||

The value of cryptocurrency is generally derived from the continued willingness of market participants to exchange fiat for cryptocurrency, which may result in the permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency diminish or disappear. | |||

The value of cryptocurrency is generally derived from the continued willingness of market participants to exchange fiat for cryptocurrency, which may result in the permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency diminish or disappear<ref>How Does Crypto Compare to Traditional Currency? https://www.tradestation.com/learn/market-basics/cryptocurrencies/the-basics/how-does-crypto-compare-to-traditional-currency/ | Accessed 26 Apr 2022</ref>. | |||

There is no assurance that persons and companies who accept cryptocurrency as payment today will continue to do so in the future. | There is no assurance that persons and companies who accept cryptocurrency as payment today will continue to do so in the future. | ||

Moreover, cryptocurrencies issued with a fixed number of units may be susceptible to deflation. | Moreover, cryptocurrencies issued with a fixed number of units may be susceptible to deflation. | ||

In 2018, the Bank for International Settlements, a 90-year-old institution based in Switzerland, issued a research report concluding that cryptocurrencies are afflicted with inherent contradictions that make their widespread use as money impossible. | |||

Most of the crypto currencies generate trust by limiting the amount of currency available, in the case of bitcoin to 21 million. The problem with that is that during periods where there is greater demand for them, the supply is unable to respond | In 2018, the Bank for International Settlements, a 90-year-old institution based in Switzerland, issued a research report concluding that cryptocurrencies are afflicted with inherent contradictions that make their widespread use as money impossible<ref>Cryptocurrencies like bitcoin cannot replace money, says Bank for International Settlements https://www.abc.net.au/news/2018-06-18/cryptocurrencies-cannot-replace-money-bis/9879448 | 18 Jun 2018. Accessed 26 Apr 2022</ref>. | ||

Most of the crypto currencies generate trust by limiting the amount of currency available, in the case of bitcoin to 21 million<ref>What Happens to Bitcoin After All 21 Million Are Mined? https://www.investopedia.com/tech/what-happens-bitcoin-after-21-million-mined/ | Accessed 30 Apr 2022</ref>. The problem with that is that during periods where there is greater demand for them, the supply is unable to respond. | |||

This is theoretically a good feature for the store of value function of money, as your savings theoretically cannot be debased by creating more of the currency, but it's not so good for the stability required for price comparisons or making transactions. | This is theoretically a good feature for the store of value function of money, as your savings theoretically cannot be debased by creating more of the currency, but it's not so good for the stability required for price comparisons or making transactions. | ||

And it can backfire too for those trying to store value — just as there is no central bank to put downward pressure on the value of money, there's also no institution there to absorb potential losses and prop up the value of cryptocurrencies in times of crisis. | And it can backfire too for those trying to store value — just as there is no central bank to put downward pressure on the value of money, there's also no institution there to absorb potential losses and prop up the value of cryptocurrencies in times of crisis. | ||

===Usage During Global Crises=== | ===Usage During Global Crises=== | ||

Owning cryptocurrency during a crisis can be very useful. Being able to store money in digital form will make it much easier to protect your wealth because you just have to protect your password or a USB stick. For example when the Ukrainian currency Hyrvnia plummeted when the war started, people turned to crypto for storing their money. By not having much cash, they were able to cross borders easily and feel safer, because at least their money was secure. | |||

Cryptocurrencies are useful during a crisis for the governments too. The Ukrainian government started accepting donations in various cryptocurrencies to help ukrainians survive. People from all over the world were able to make direct donations to Ukraine, which proved to be very successful, because by March 9nth, they had already raised nearly 100million USD from just crypto alone. | |||

Critics of crypto have speculated that Russia may be able to evade sanctions by the West by using cryptocurrencies. Although legitimate concerns, so far there haven’t been any occurrences of transactions that aim to evade the sanctions. Additionally, large scale evasion is practically impossible due to limited liquidity and technological barriers.<ref>Arasasingham, Aidan. “Cryptocurrency’s Role in the Russia-Ukraine Crisis.” Center for Strategic and International Studies, www.csis.org/analysis/cryptocurrencys-role-russia-ukraine-crisis. Accessed 31 Mar. 2022.</ref> | |||

How did the COVID crisis affect the cryptomarket? In short, the largest cryptocurrency Bitcoin saw a 640% rise as did many others. There are many variables that contributed to this huge rise. For example the fear of central banks or governments interfering with the markets during the crisis made decentralized currencies more attractive to investors. Hadar Y. Jabotinsky and Roee Sarel in their paper “How Crisis Affects Crypto: Coronavirus as a Test Case” found: “(possibly) people were initially panicking – pulling out of traditional markets but returning to them after the dimensions of the crisis became clearer.”<ref>Coffee, John C., Jr, et al. “How the Covid-19 Pandemic Affected the Cryptocurrency Market | CLS Blue Sky Blog.” CLS, 26 Mar. 2021, clsbluesky.law.columbia.edu/2021/03/26/how-the-covid-19-pandemic-affected-the-cryptocurrency-market. Accessed 2.04.2022</ref> | |||

==Technology== | ==Technology== | ||

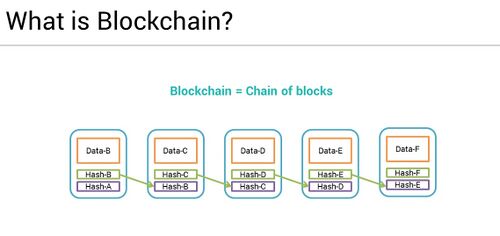

=== | [[File:blockchain.jpeg|500px|thumb|right|Chain of Blocks<ref>Lange, G. (2018). Bitcoin. Block-Builders. Retrieved from https://block-builders.de/kryptowaehrungen/bitcoin/ | Accessed 1 May 2022</ref>]]Almost all cryptocurrencies are built on blockchain technology. Simply put it’s a decentralized ledger of all transactions on its network. The data on the blockchain is not modifiable. Blockchain essentially makes the history of a cryptocurrency unalterable and transparent. | ||

Blockchain consists of three elements: blocks, nodes and miners. Blocks contain a piece of data, a nonce (32bit randomly generated number) and a hash (generated from the nonce). Every block has its own unique nonce and hash, but also the hashes of the block before it. This creates a chain. | |||

Miner's objective is to solve the incredibly complex math problem of finding the nonce from the generated hash. There are billions of possible combinations for these hashes, so miners have a lot of work. When the correct hash is found, the miners are awarded. It’s practically impossible to manipulate data on the blockchain, because making a change to one block would require re-mining of that block, and all the blocks that come after it. <ref>“What Is Blockchain Technology? How Does It Work? | Built In.” Built In, builtin.com/blockchain. Accessed 7 Mar. 2022.</ref> | |||

Nodes are devices that own copies of the blockchain and keep the network functioning. Every change (new mined block) in the chain has to be approved and verified by the network of nodes. Because blockchain is transparent, every action can quite easily be checked.<ref>PricewaterhouseCoopers. “Making Sense of Bitcoin, Cryptocurrency and Blockchain.” PwC, www.pwc.com/us/en/industries/financial-services/fintech/bitcoin-blockchain-cryptocurrency.html. Accessed 8 Mar. 2022.</ref> | |||

===Disadvantages=== | |||

Blockchain relies on the legitimacy of the nodes on the network. For the network to properly check and validate the transactions, at least 51% of the nodes must be valid. If someone was able to control over 51% of the nodes and change some data in the chain in all of those nodes, this change would become the new truth for the entire network. This is called the 51% attack. | |||

Blockchains can consume too much energy. Solving complex math problems can take a lot of processing power, which consumes energy. This can be a very big problem if the network grows big enough. For example bitcoin’s network consumes the energy equivalent of about the annual energy consumption of Sweden. | |||

Blockchain allows users to be their own banks, to control their own money. The disadvantage with this is that people often tend to forget or lose their stuff, in this case passwords or secret keys. If your key is lost, there is no recovering your account. | |||

==Government & Regulations== | ==Government & Regulations== | ||

===Digital Divide=== | ===Digital Divide=== | ||

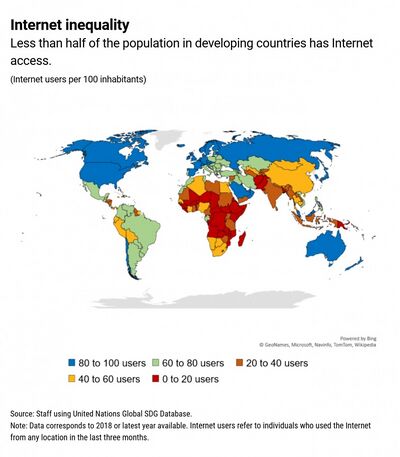

[[File:Internet_inequality.jpeg|400px|thumb|right|Graph of Countries and Internet Access<ref>Low Internet Access Driving Inequality. https://blogs.imf.org/2020/06/29/low-internet-access-driving-inequality/ | 29 Jun 2020. Accessed 26 Apr 2022</ref>]] | [[File:Internet_inequality.jpeg|400px|thumb|right|Graph of Countries and Internet Access<ref>Low Internet Access Driving Inequality. https://blogs.imf.org/2020/06/29/low-internet-access-driving-inequality/ | 29 Jun 2020. Accessed 26 Apr 2022</ref>]] | ||

We define the digital divide as the gap between members of society who have access to digital technologies (not only access to the Internet, but also to devices, such as computers and smartphones) and those who do not. | We define the ''digital divide''<ref>"Digital Divide" https://dictionary.cambridge.org/dictionary/english/digital-divide | Accessed 30 Apr. 2022</ref> as the gap between members of society who have access to digital technologies (not only access to the Internet, but also to devices, such as computers and smartphones) and those who do not. | ||

The socio-economical disadvantages faced by those who suffer from digital divide are, among others: | |||

Learning and researching option are drastically reduced | The socio-economical disadvantages faced by those who suffer from digital divide are, among others<ref>Digital Divide https://www.investopedia.com/the-digital-divide-5116352 | Accessed 26 Apr 2022</ref>: | ||

Inability to expand their business reach | <ul> | ||

Limited means to find and apply for jobs | <li>Learning and researching option are drastically reduced</li> | ||

Restricted purchasing options, being unable to benefit from the ones that are online | <li>Inability to expand their business reach</li> | ||

Limited way to participate to democratic life, for example through voting | <li>Limited means to find and apply for jobs</li> | ||

<li>Restricted purchasing options, being unable to benefit from the ones that are online</li> | |||

<li>Limited way to participate to democratic life, for example through voting</li> | |||

</ul> | |||

According to reports from the United Nations<ref>With Almost Half of World’s Population Still Offline, Digital Divide Risks Becoming ‘New Face of Inequality’, Deputy Secretary-General Warns General Assembly. https://www.un.org/press/en/2021/dsgsm1579.doc.htm | 21 Apr 2021. Accessed 26 Apr. 2022</ref> and World Bank<ref>Connecting for Inclusion: Broadband Access for All. https://www.worldbank.org/en/topic/digitaldevelopment/brief/connecting-for-inclusion-broadband-access-for-all | Accessed 26 Apr 2022</ref> almost half of the world still does not have access to the Internet, as per April 2021.Particularly, data showed that, on average, developing countries’ internet penetration rate is around 35% (with the lowest valley recorded in Africa, with only 26%) compared to developed countries of 80%. Moreover, an increase in GDP of about 2 trillion US dollars and the creation of more than 140 million jobs have been estimated to be achieved by raising internet penetration to 75% in developing countries. | According to reports from the United Nations<ref>With Almost Half of World’s Population Still Offline, Digital Divide Risks Becoming ‘New Face of Inequality’, Deputy Secretary-General Warns General Assembly. https://www.un.org/press/en/2021/dsgsm1579.doc.htm | 21 Apr 2021. Accessed 26 Apr. 2022</ref> and World Bank<ref>Connecting for Inclusion: Broadband Access for All. https://www.worldbank.org/en/topic/digitaldevelopment/brief/connecting-for-inclusion-broadband-access-for-all | Accessed 26 Apr 2022</ref> almost half of the world still does not have access to the Internet, as per April 2021.Particularly, data showed that, on average, developing countries’ internet penetration rate is around 35% (with the lowest valley recorded in Africa, with only 26%) compared to developed countries of 80%. Moreover, an increase in GDP of about 2 trillion US dollars and the creation of more than 140 million jobs have been estimated to be achieved by raising internet penetration to 75% in developing countries. | ||

| Line 97: | Line 129: | ||

The two factors that have been hindering the spread of the Internet are: high infrastructure costs to fund rural, remote, or sparsely populated areas and the lack of funding as a result of high infrastructure costs. | The two factors that have been hindering the spread of the Internet are: high infrastructure costs to fund rural, remote, or sparsely populated areas and the lack of funding as a result of high infrastructure costs. | ||

As of lately, however, thanks to a promising new iteration of the WiFi technology (namely 6G) combined with a blockchain platform, many companies have expressed interest in venturing into researching and developing solutions for a mesh network that could cover those problematic areas. | As of lately, however, thanks to a promising new iteration of the WiFi technology (namely 6G) combined with a blockchain platform, many companies have expressed interest in venturing into researching and developing solutions for a mesh network that could cover those problematic areas<ref>New Crypto Coin Launch To Solve The Global Digital Divide https://halalop.com/business/crypto-coin-to-solve-global-digital-divide/ | 01 Nov 2021. Accessed 26 Apr 2022</ref>. | ||

A blockchain platform, combined with wireless mesh network technology, can put an end to the digital divide by providing affordable broadband internet access to remote areas. | A blockchain platform, combined with wireless mesh network technology, can put an end to the digital divide by providing affordable broadband internet access to remote areas<ref>Reducing the Digital Divide Using Blockchain https://www.unicef.org/innovation/stories/reducing-digital-divide-using-blockchain | 18 Jun 2019. Accessed 26 Apr 2022</ref>. | ||

The specific solution for Africa is a mix of extensive 4G coverage for outdoors and cheap-to-implement WiFi for indoor and stationary users. | The specific solution for Africa is a mix of extensive 4G coverage for outdoors and cheap-to-implement WiFi for indoor and stationary users. | ||

| Line 115: | Line 147: | ||

===Regulations=== | ===Regulations=== | ||

===' | Up until 2021, there were very few laws across the world that would regulate the market and usage of cryptocurrencies. | ||

As Bitcoin, for example, is not backed by tangible assets and it lacks the need of governmental and intermediately control, therefore undermining the 'Cycle of Trust' of traditional currency. | |||

Furthermore, it's increasingly difficult to define, and put cryptocurrencies into an existing box, as there are so many different uses of it - legal tender to pay for goods, investing into it as an asset, and the non-fungible tokens. <ref>McWhinney, James. “Why Governments Are Wary of Bitcoin.” Investopedia, 21 Sept. 2021, www.investopedia.com/articles/forex/042015/why-governments-are-afraid-bitcoin.asp. Accessed 21.03.2022</ref> | |||

Despite this, cryptocurrencies can be bought and traded all across the world. <ref>LAWS STUDY. “Cryptocurrency Regulations around the World 2022.” LAWS STUDY, 22 Feb. 2022, lawsstudy.com/cryptocurrency-regulations-around-the-world. Accessed 02.03.2022</ref> | |||

====European Union==== | |||

On the 14th of March, the EU Economic and Monetary Affairs Committee voted favourably towards the Markets in Crypto Assets(MiCA), a legislation that specifies the issuance and trading of crypto, as well as address the complications due to proof-of-work currencies for the environment. | |||

The bill will also set boundaries for market manipulation and prevention of money laundering, terrorism and criminal activities funded by crypto. | |||

The original bill also included a clause to ban proof-of-work currencies amid climate crisis, however after receiving backlash from cryptocurrency experts and traders, they removed it as it would have banned bitcoin from the entire EU. <ref>Handagama, Sandali. “EU’s Sweeping Crypto Regulations Package One Step Closer to Ratification.” Coin Desk, 14 Mar. 2022, www.coindesk.com/policy/2022/03/14/eus-sweeping-crypto-regulations-package-one-step-closer-to-ratification. Accessed 13.03.2022</ref> | |||

Furthermore, the industry leaders felt like the government should not be able to dictate the methods used nor discriminate by technology when it comes to crypto. A french legislator even went as far to call that clause to "mortifying the competitiveness while, at the same time, President Biden has signed an act calling for the US to fully embrace this new ecosystem". <ref>Handagama, Sandali. “Limiting Proof-of-Work Crypto Back on the Table as EU Parliament Prepares Virtual Currencies Vote.” Coin Desk, 12 Mar. 2022, www.coindesk.com/policy/2022/03/12/limiting-proof-of-work-crypto-back-on-the-table-as-eu-parliament-prepares-virtual-currencies-vote. Accessed at 30.03.2022</ref> | |||

The bill currently has 4 objctives <ref>Vern. “MiCA: A Guide to the EU’s Proposed Markets in Crypto-Assets Regulation.” Sygna, 7 May 2021, www.sygna.io/blog/what-is-mica-markets-in-crypto-assets-eu-regulation-guide. Accessed 10.03.2022</ref>: | |||

<ol> | |||

<li> provide legal stability for crypto based assets not currently covered by financial legislation</li> | |||

<li> create uniform rules for service providers and issuers on EU scope</li> | |||

<li>replace out-dated frameworks | |||

<li> establish rules and regulations for stablecoins, including electronic money | |||

</ol> | |||

The MiCA also introduces legal definitions for crypto-assets: | |||

<ul> | |||

<li>Utility tokens - have non-financial purpose to access an application, service or resource on the ledger network.</li> | |||

<li>Asset-referenced tokens - stable value tokens which reference legal tender currencies and may be used either as a means of payment or a store of value.</li> | |||

<li>e-money tokens - stable value tokens that are anchored to only one fiat currency, that is meant to use as electronic money.</li> | |||

</ul> | |||

The difference between an asset-referenced tokens (ART) and e-money is that e-money refers to a single fiat currency, while ART can be tied to many fiat currencies, can be one or many assets or a combination. | |||

The bill will also require a whitepaper containing core information, rights and obligations, technology, and a project for all issuers of MiCA assets. This will help combat the rampant pump and dump schemes currently in the crypto-market as well as help protect consumers' rights. | |||

This will also include a 14-day withdrawal right from purchase of crypto asset if bought directly. | |||

MiCA proposes financial sanctions for market manipulation, including insider trading, market manipulation and disclosure of inside information. <ref>Vern. “MiCA: A Guide to the EU’s Proposed Markets in Crypto-Assets Regulation.” Sygna, 7 May 2021, www.sygna.io/blog/what-is-mica-markets-in-crypto-assets-eu-regulation-guide. Accessed 10.03.2022</ref> | |||

====United States of America==== | |||

Currently, there is no one regulation put into place for crypto-assets in the US. | |||

The assets fall under many different governing bodies, such as The U.S. Securities and Exchange Commission (SEC), which sees cryptocurrencies as securities, and fall under pre-existing laws regarding securities, The Commodities Futures Trading Commission (CFTC), however, sees the currencies as commodities. | |||

Companies which specialise in cryptocurrency exchanges are currently legal in all states and must implement anti-money laundering and know your customers schemes to be compliant with the Bank Secrecy Act. | |||

Regarding crime financing, the government is able to track and blacklist illegal crypto-transactions using forensic blockchain analysts, even with privacy coins like Monero.<ref>Farrington, William. “Balancing Act: A Report Into the Future of US Crypto Regulation.” Currency.Com, 27 Apr. 2022, currency.com/us-crypto-regulation-report. Accessed 28.04.2022</ref> | |||

With the support from both parties - republicans and democrats - the new regulations should be on the way, however conflicting views about the crypto-technology is holding the new legislation back with a hearing scheduled for 2023. | |||

===Social Intelligence=== | ===Social Intelligence=== | ||

Cryptocurrency trading is gaining popularity very fast. Especially as a large portion of the population either couldn’t go to work or was out of work during the pandemic,the influx of fresh blooded retail traders started creating a hype around crypto. A range of new trading platforms, especially mobile, came to life, some of which were maye rightly accused by lawmakers for gamifying trading, offering rewards to users who make trades over a certain amount in a short period of time, having arcade-like graphics and holding trading competitions. While how much responsibility the platforms should take considering all the users are adults who are deemed capable of making their own decisions is up for debate, this environment of excitement created a whole new segment of data, based on crypto social media. | Cryptocurrency trading is gaining popularity very fast. Especially as a large portion of the population either couldn’t go to work or was out of work during the pandemic,the influx of fresh blooded retail traders started creating a hype around crypto. A range of new trading platforms, especially mobile, came to life, some of which were maye rightly accused by lawmakers for gamifying trading, offering rewards to users who make trades over a certain amount in a short period of time, having arcade-like graphics and holding trading competitions. While how much responsibility the platforms should take considering all the users are adults who are deemed capable of making their own decisions is up for debate, this environment of excitement created a whole new segment of data, based on crypto social media. | ||

| Line 121: | Line 187: | ||

The fact that “Crypto Twitter” is a term widely known and used is a good indication of what a big role social media platforms play in the synergy surrounding cryptocurrencies. Many retail users get trading tips and setups from social media influencers who are “crypto experts”. Even billionaires like Elon Musk use Twitter to tweet seem,ngly random tweets about seemingly random cryptocurrencies and send their prices to the moon(some people call this market manipulation). This high level of activity naturally creates a huge amount of data. This is where a relatively new technology called “sentiment analysis” or “opinion mining” comes into play. | The fact that “Crypto Twitter” is a term widely known and used is a good indication of what a big role social media platforms play in the synergy surrounding cryptocurrencies. Many retail users get trading tips and setups from social media influencers who are “crypto experts”. Even billionaires like Elon Musk use Twitter to tweet seem,ngly random tweets about seemingly random cryptocurrencies and send their prices to the moon(some people call this market manipulation). This high level of activity naturally creates a huge amount of data. This is where a relatively new technology called “sentiment analysis” or “opinion mining” comes into play. | ||

The main objective in sentiment analysis is to evaluate the public opinion using the social media posts of people and analyzing them using “natural language processing”, biometics, computational linguistics and similar techniques that are supposed to be able to pick up human emotions and context only through text.<ref>Shivanandhan, Manish. “What Is Sentiment Analysis? A Complete Guide for Beginners.” freeCodeCamp.Org, 30 Sept. 2020, www.freecodecamp.org/news/what-is-sentiment-analysis-a-complete-guide-to-for-beginners.</ref> Sentiment analysis actually has a longer history than what most might imagine, supposedly even playing a role in Barack Obama’s victory in 2008 US Presidential Elections. Later it got adapted by large online marketplaces like Amazon, who used it to go though buyer comments and classify them according to their urgency levels and content(apparently before employing AI, Bezos himself would respond to every comment). Nowadays, sentiment analysis has proven to be a crucial part of holding the pulse of markets.<ref>“Sentiment Analysis Guide.” MonkeyLearn, monkeylearn.com/sentiment-analysis. Accessed 26 Apr. 2022.</ref> | |||

In the crypto space, sentiment analysis is done based on metrics such as increase/decrease in mentions, engagements, clicks, shared links, the number of posts, number of contributors and the like. Different coins, exchanges and crypto influencers are evaluated based on these metrics. One can also see the top 10 most talked about coins of the day, the ones where the cumulative metric has risen or fallen the most, the ones where the public sentiment is the most positive or negative etc. | In the crypto space, sentiment analysis is done based on metrics such as increase/decrease in mentions, engagements, clicks, shared links, the number of posts, number of contributors and the like. Different coins, exchanges and crypto influencers are evaluated based on these metrics. One can also see the top 10 most talked about coins of the day, the ones where the cumulative metric has risen or fallen the most, the ones where the public sentiment is the most positive or negative etc. | ||

Due to the fact that cryptocurrencies and their trading are still in their infancies, data regarding their trading is still scarce. One can’t go back 50 years to observe a larger trend, the history is still being written, in very grand terms. And this history is being shaped in a very different way than a traditional, centralized market structure.Since crypto came to existence during an era of very fast evolving technologies and social dynamics, its market dynamics also reflect this very nimble and maybe fickle structure. This highly variant composition can also be seen in the data gathered from sentiment analysis. The most mentioned coins on Twitter change on a daily basis, so do the trending buzzwords, maybe less frequently. But anyone who has been in the crypto space for the last few years can attest to the boom of “defi”, now to be replaced by the “nft” craze. Nobody can know for sure what will be the new “it” thing in a year, but one thing is for sure, whenever that “it” becomes “it”, crypto twitter will be the first to know about it. | Due to the fact that cryptocurrencies and their trading are still in their infancies, data regarding their trading is still scarce. One can’t go back 50 years to observe a larger trend, the history is still being written, in very grand terms. And this history is being shaped in a very different way than a traditional, centralized market structure.Since crypto came to existence during an era of very fast evolving technologies and social dynamics, its market dynamics also reflect this very nimble and maybe fickle structure. This highly variant composition can also be seen in the data gathered from sentiment analysis. The most mentioned coins on Twitter change on a daily basis, so do the trending buzzwords, maybe less frequently. But anyone who has been in the crypto space for the last few years can attest to the boom of “defi”, now to be replaced by the “nft” craze. Nobody can know for sure what will be the new “it” thing in a year, but one thing is for sure, whenever that “it” becomes “it”, crypto twitter will be the first to know about it. | ||

===='Pump and Dump' Schemes==== | |||

The most known definition of a pump and dump scheme originates from the late 90s, where fraudsters would buy stocks, call/email people to hype up the stock, artificially inflating the price. When that was achieved, they'd sell all of their stocks at the high, making a huge profit for themselves while the people investing would lose all their money.<ref>“Pump and Dump Schemes” Investor.Gov, www.investor.gov/introduction-investing/investing-basics/glossary/pump-and-dump-schemes. Accessed 27 Mar. 2022.</ref> | |||

Although the original scams involving the stock market have been eradicated by the stern regulations, a new branch has emerged thanks to lax legislation as well as the crypto scene in social media. | |||

[[File:mcafee.jpeg|200px|thumb|right|John McAfee<ref>https://media.wired.com/photos/593284509be5e55af6c25963/master/w_1000,c_limit/Wired_McAfee.jpg|Accessed 27 Apr 2022</ref>]] | |||

Due to the social influence and novelty of the blockchain development, people with high social status and following are free to manipulate the market for their financial gain - creating, pumping and then pumping various currencies. | |||

The initial rise and success of Bitcoin paved a way to create a fear of missing out among casual consumers, allowing fraudsters to manipulate them into buying a new, unknown currency, therefore inflating the price. As there are little to no regulations regarding cryptocurrencies and crypto market manipulation, the scams have become rampant with no consequences to the perpetrators, making it an attractive scheme to make a quick buck. <ref>Phemex. “What Is Pump and Dump: Crypto Market Manipulation - Phemex Academy.” Phemex, 28 Jan. 2022, phemex.com/academy/what-is-pump-and-dump. Accessed 19.03.2022</ref> | |||

Many influencers and celebrities have promoted 'memecoins', while simultaneously being paid to promote the coin as well as holding a significant amount of the coin to dump when the price reaches an all time high. | |||

=====John McAfee===== | |||

One of the most notable instances of the governing bodies taking a stance on crypto pump and dumps has been the John McAfee case, who was charged with wire fraud, conspiracy to commit commodities and securities fraud, and conspiracy to commit money laundering. | |||

He used his notable following on the social media site Twitter and his social standing to inflate the prices of Dogecoin and Reddcoin, then selling his whole share when the price reached an all time high. | |||

Allegedly him and his bodyguard earned over 2 million dollars from suggesting "Coin of the Day" and "Coin of the Week", and urging his followers to buy the currencies. | |||

<ref>Robertson, Adi. “John McAfee Charged With Securities Fraud for ‘Pump and Dump’ Cryptocurrency Scheme.” The Verge, 5 Mar. 2021, www.theverge.com/2021/3/5/22315494/john-mcafee-fraud-securities-scheme-charges-cryptocurrency. Accessed 12.03.2022</ref> | |||

=====Save the Kids Token===== | |||

One of the biggest scandals of the summer of 2021 involved one of the world's biggest e-sports teams Faze and big influencers, who got caught promoting a fake charity token by the name "Save the Kids". | |||

Allegedly, the token had in place anti-whale measures, which would prevent someone with a large stake in token to sell before 5 days, however the code was changed last minute before the launch to let whales sell all their tokens after 5 minutes. | |||

An independent investigation using wallet addresses, and tracing the transactions revealed that many members of the FaZe Clan had received massive amounts of the token prior to launch and subsequently sold them after the value had been inflated. | |||

As the coin was marketed as a "charity currency", where every transaction would donate a portion to charity, the whole scam became even bigger of a scandal. | |||

<ref>Sacco, Dom. “Scam the Kids: The ‘Save the Kids’ Crypto Scandal Involving Several UK YouTubers Is a Painful Reminder of the Volatility of Cryptocurrency and the Dangers of Trusting Influencers – Opinion.” ENUK, 2 July 2021, esports-news.co.uk/2021/07/02/save-the-kids-cryptocurrency-scandal-faze-influencers-opinion. Accessed 24.04.2022</ref> | |||

==Future of Cryptocurrency== | ==Future of Cryptocurrency== | ||

[[File:musk_doge.png|200px|thumb|left|Elon Musk on Dogecoin<ref>Elon Musk on Twitter: Dogecoin Rulz Available at: https://twitter.com/elonmusk/status/1113173498384441344?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1113173498384441344%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fmarketrealist.com%2Fp%2Felon-musk-dogecoin-tweets%2F - Accessed 26 Apr 2022</ref>]] | |||

Since the whole concept of cryptocurrencies has been around for barely longer than 10 years, it is hard to predict what the next ten years will bring. Though, there are a few factors that have been in everyone’s minds. | Since the whole concept of cryptocurrencies has been around for barely longer than 10 years, it is hard to predict what the next ten years will bring. Though, there are a few factors that have been in everyone’s minds. | ||

<ol> | |||

<li>'''Regulations:'''</li> | |||

Due to their “high risk” nature and wide adaptation by illegal actors, according to governments, we have seen a rise in efforts to regulate the crypto space in the last few years. While a critical mind could just consider this a not so subtle ploy to demand more tax payments from the public, it is beyond doubt the crypto industry, be it centralized exchanges, personal investors or businesses that use cryptocurrencies in one form or the other will be facing a new wave of regulations in the near future. | |||

<li>'''Adaptation by mainstream finance'''</li> | |||

As crypto goes under the control of governments, even though it probably becomes less appealing to the cypherpunks, it does become a more accessible instrument for traditional finance. Tech giants like Tesla are starting to hold Bitcoin in their balance sheets, some like Facebook and Amazon are starting to implement blockchain in their platforms, and banks are trying to lure traditional investors by creating crypto ETFs(exchange traded funds). | |||

<li>'''Elon Musk:'''</li> | |||

Elon Musk and his meaningful tweets(which are kindly shared with the public on a platform he of yesterday-25th of April, 2022- owns), have power beyond anyone’s wildest imaginations.<ref>Elon Musk on Twitter: Dogecoin Rulz Available at: https://twitter.com/elonmusk/status/1113173498384441344?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1113173498384441344%7Ctwgr%5E%7Ctwcon%5Es1_&ref_url=https%3A%2F%2Fmarketrealist.com%2Fp%2Felon-musk-dogecoin-tweets%2F - Accessed: 4/26/2022</ref> | |||

</ol> | |||

===Environmental Impact=== | |||

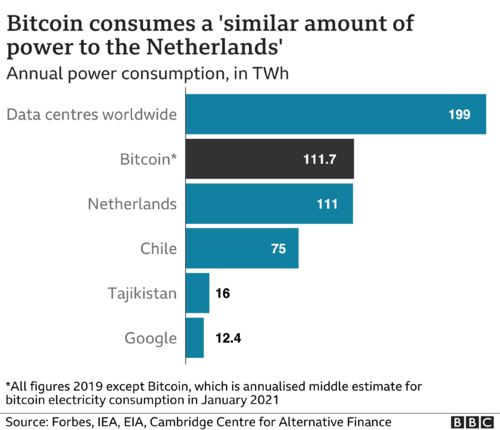

Crypto currencies have been highly criticized for having a very high carbon footprint. Since we are talking about a digital currency, which therefore means it is by definition an “immaterial” commodity, bears the question: how? | |||

How can a string of zeros and ones have environmental impact? | |||

Everything is connected to the concept of crypto mining, in which “miners” compete to append blocks and mint new currency, each miner experiencing a success probability proportional to the computational effort expended. This form of cryptographic proof in which one party (the prover) proves to others (the verifiers) that a certain amount of a specific computational effort has been expended is called Proof of Work (PoW), and it’s been popularized by Bitcoin. | |||

[[File:bitcoin_power_cons.png|500px|thumb|right|Bitcoin Power Consumption<ref>How Bitcoin's vast energy use could burst its bubble https://www.bbc.com/news/science-environment-56215787 | Accessed 30 Apr 2022</ref>]] | |||

Mining for proof-of-work cryptocurrencies requires enormous amounts of electricity and consequently comes with a large carbon footprint. Proof-of-work (PoW) blockchains such as Bitcoin, Ethereum, Litecoin, and Monero were estimated to have added 3 to 15 Mt (million tonnes) of CO2 emissions to the atmosphere in the period from January 1, 2016 to June 30, 2017. By November 2018, Bitcoin was estimated to have an annual energy consumption of 45.8 TWh (teraWatt-hour), generating 22 to 22.9 Mt of CO2<ref>How Bitcoin's vast energy use could burst its bubble https://www.bbc.com/news/science-environment-56215787 | Accessed 30 Apr 2022</ref>. By the end of 2021, Bitcoin was estimated to produce 65.4 Mt of CO2 and consume between 91 and 177 TWh annually. As of 2022, the Cambridge Centre for Alternative Finance<ref>Cambridge Bitcoin Electricity Consumption Index https://ccaf.io/cbeci/index | Accessed 26 Apr 2022</ref> (CCAF) estimates that Bitcoin consumes 131 TWh annually, representing 0.29% of the world's energy production. | |||

For what concerns electricity consumption, the world's second-largest cryptocurrency, Ethereum, uses 62.56 kWh per transaction. XRP is currently the world's most energy efficient cryptocurrency, only using 0.0079 kWh of electricity per transaction<ref>Bitcoin and Ethereum Among the Top 3 Most Polluting Cryptocurrencies https://thefintechtimes.com/bitcoin-and-ethereum-among-the-top-3-most-polluting-cryptocurrencies/ | Accessed 30 Apr 2022</ref>. | |||

Until 2021, according to the CCAF much of Bitcoin mining was done in China<ref>Bitcoin price surge could be ruining the environment because it uses so much energy. https://www.independent.co.uk/tech/bitcoin-environment-green-energy-power-global-warming-climate-change-a8094661.html | Accessed 30 Apr 2022</ref>. Chinese miners used to rely on cheap coal power in Xinjiang in late autumn, winter and spring, and then migrate to regions with overcapacities in low-cost hydropower, like Sichuan, between May and October. In June 2021 China banned Bitcoin mining and Chinese miners moved to other countries such as the US and Kazakhstan. | |||

As of September 2021, according to the New York Times<ref>Huang, Jon; O’Neill, Claire; Tabuchi, Hiroko (2021-09-03). "Bitcoin Uses More Electricity Than Many Countries. How Is That Possible?". The New York Times. ISSN 0362-4331 https://www.nytimes.com/interactive/2021/09/03/climate/bitcoin-carbon-footprint-electricity.html | Accessed 30 Apr 2022</ref>, Bitcoin's use of renewables ranges from 40% to 75%. According to the Bitcoin Mining Council and based on a survey of 32% of the current global bitcoin network, 56% of bitcoin mining came from renewable resources in the second quarter of 2021. | |||

Concerns about bitcoin's environmental impact relate bitcoin's energy consumption to carbon emissions. The difficulty of translating the energy consumption into carbon emissions lies in the decentralized nature of Bitcoin, impeding the localization of miners to examine the electricity mix used. The results of recent studies analyzing bitcoin's carbon footprint vary. A 2018 study published in Nature Climate Change by Mora et al. claimed that bitcoin "could alone produce enough CO2 emissions to push warming above 2 °C within less than three decades. However, three other studies also published in Nature Climate Change later dismissed this analysis on account of its poor methodology and false assumptions. For example, one study done by Michael Novogratz's Galaxy Digital claimed that Bitcoin mining used less energy than the traditional banking system. | Concerns about bitcoin's environmental impact relate bitcoin's energy consumption to carbon emissions. The difficulty of translating the energy consumption into carbon emissions lies in the decentralized nature of Bitcoin, impeding the localization of miners to examine the electricity mix used. The results of recent studies analyzing bitcoin's carbon footprint vary. A 2018 study published in Nature Climate Change by Mora et al. claimed that bitcoin "could alone produce enough CO2 emissions to push warming above 2 °C within less than three decades. However, three other studies also published in Nature Climate Change later dismissed this analysis on account of its poor methodology and false assumptions. For example, one study done by Michael Novogratz's Galaxy Digital claimed that Bitcoin mining used less energy than the traditional banking system. | ||

Predictions about bitcoin consuming the entire world's electricity are probably sensationalistic, but it is clear that more specialized research is very much needed, alongside careful monitoring and rigorous analysis. | Predictions about bitcoin consuming the entire world's electricity are probably sensationalistic, but it is clear that more specialized research is very much needed, alongside careful monitoring and rigorous analysis. | ||

BIS report of 2018 contains a section pertaining to crypto mining and its environmental implications. | BIS report of 2018 contains a section pertaining to crypto mining and its environmental implications. | ||

====Electronic waste==== | ====Electronic waste==== | ||

Bitcoins annual e-waste is estimated to be about 30 metric tons as of May 2021. It is also estimated that one Bitcoin generates between 272 and 380 grams of e-waste per transaction. This is worsened by the fact that the average lifespan of Bitcoin mining devices is estimated to be only 1.29 years: the effectiveness of the mining process is tightly linked to having state-of-the-art equipment. Mining hardware is improving at a fast rate, quickly resulting in older generations of hardware being disposed of. To add insult to injury, mining uses application-specific integrated circuits which, unlike most computing hardware, have no alternative use. | Bitcoins annual e-waste is estimated to be about 30 metric tons as of May 2021. It is also estimated that one Bitcoin generates between 272 and 380 grams of e-waste per transaction<ref>de Vries, Alex; Stoll, Christian (1 December 2021). "Bitcoin's growing e-waste problem". Resources, Conservation and Recycling. 175: 105901. doi:10.1016/j.resconrec.2021.105901. ISSN 0921-3449. S2CID 240585651 | Accessed 30 Apr 2022</ref>. This is worsened by the fact that the average lifespan of Bitcoin mining devices is estimated to be only 1.29 years: the effectiveness of the mining process is tightly linked to having state-of-the-art equipment. | ||

Mining hardware is improving at a fast rate, quickly resulting in older generations of hardware being disposed of. To add insult to injury, mining uses application-specific integrated circuits which, unlike most computing hardware, have no alternative use<ref>Bitcoin mining producing tonnes of waste https://www.bbc.com/news/technology-58572385 | Accessed 30 Apr 2022</ref>. | |||

====Efforts to reduce the impact==== | ====Efforts to reduce the impact==== | ||

Some major cryptocurrencies are implementing technical measures to reduce the negative environmental impact. | Some major cryptocurrencies are implementing technical measures to reduce the negative environmental impact. | ||

Bitcoin developers are working on the Lightning Network that would reduce energy demand of the network by moving most transactions off the blockchain. | |||

Ethereum is planning a transition from the Proof of Work to the Proof of Stake algorithm. This could reduce the network's energy demand by around 99%. | Bitcoin developers are working on the Lightning Network<ref>Lightning Network https://lightning.network/ | Accessed 30 Apr 2022</ref> that would reduce energy demand of the network by moving most transactions off the blockchain. | ||

The development of intermittent renewable energy sources, such as wind power and solar power, is challenging because they cause instability in the electrical grid. Several papers concluded that these renewable power stations could use the surplus energy to mine Bitcoin and thereby reduce curtailment, hedge electricity price risk, stabilize the grid, increase the profitability of renewable energy infrastructure, and therefore accelerate transition to sustainable energy and decrease Bitcoin's carbon footprint. | |||

Reversible computing chips and hash recycling could possibly provide some advantage to bitcoin mining in forms of reduced energy usage and e-waste, but reversible computing is still at its early stages. More research and development is needed on reversible bitcoin mining chips and also hash recycling for providing entropy to pseudorandom number generation. | Ethereum is planning a transition from the Proof of Work to the Proof of Stake algorithm<ref>PROOF-OF-STAKE (POS) https://ethereum.org/en/developers/docs/consensus-mechanisms/pos/ | Accessed 30 Apr 2022</ref>. This could reduce the network's energy demand by around 99%. | ||

The development of intermittent renewable energy sources, such as wind power and solar power, is challenging because they cause instability in the electrical grid. Several papers concluded that these renewable power stations could use the surplus energy to mine Bitcoin and thereby reduce curtailment, hedge electricity price risk, stabilize the grid, increase the profitability of renewable energy infrastructure, and therefore accelerate transition to sustainable energy and decrease Bitcoin's carbon footprint<ref>Can cryptocurrency ever be environmentally friendly? https://www.dw.com/en/bitcoin-can-cryptocurrency-mining-ever-be-environmentally-friendly/a-60818440 | Accessed 30 Apr 2022</ref>. | |||

Reversible computing chips and hash recycling could possibly provide some advantage to bitcoin mining in forms of reduced energy usage and e-waste, but reversible computing is still at its early stages. More research and development is needed on reversible bitcoin mining chips and also hash recycling for providing entropy to pseudorandom number generation<ref>Bitcoin Electronic Waste Monitor https://digiconomist.net/bitcoin-electronic-waste-monitor/ | Accessed 30 Apr 2022</ref>. | |||

Climate-related criticism of Bitcoin is primarily based on the network’s absolute carbon emissions, without considering its market value. However, when taking a relative emission perspective that connects Bitcoin’s carbon emissions to its market value, one study suggests that Bitcoin investments can be less carbon-intensive than standard equity investments. The addition of Bitcoin to a diversified equity portfolio can thus reduce the portfolio’s aggregate carbon footprint. | Climate-related criticism of Bitcoin is primarily based on the network’s absolute carbon emissions, without considering its market value. However, when taking a relative emission perspective that connects Bitcoin’s carbon emissions to its market value, one study suggests that Bitcoin investments can be less carbon-intensive than standard equity investments. The addition of Bitcoin to a diversified equity portfolio can thus reduce the portfolio’s aggregate carbon footprint. | ||

A 2022 study concluded that cryptocurrencies and other blockchain applications can support the transition to a circular economy and the underlying three principles of reducing, reusing, and recycling. Cryptocurrencies and token rewards can be used to incentivize the sustainable behavior of individuals. For example, token reward models can incentivize individuals to recycle. There are also several plastic cleanup incentive mechanisms that rely on token rewards. | |||

A 2022 study concluded that cryptocurrencies and other blockchain applications can support the transition to a circular economy and the underlying three principles of reducing, reusing, and recycling<ref>Is Bitcoin Inherently Bad For The Environment? https://www.forbes.com/sites/joshuarhodes/2021/10/08/is-bitcoin-inherently-bad-for-the-environment/?sh=228eae323033 | Accessed 30 Apr 2022</ref>. Cryptocurrencies and token rewards can be used to incentivize the sustainable behavior of individuals. For example, token reward models can incentivize individuals to recycle. There are also several plastic cleanup incentive mechanisms that rely on token rewards. | |||

==References== | ==References== | ||

<ul> | <ul> | ||

<li>DailyCoin. “What Happens to ETH If It Becomes PoS?” DailyCoin.Com, 5 July 2021, dailycoin.com/what-happens-to-eth-if-it-becomes-pos.</li> | <li>DailyCoin. “What Happens to ETH If It Becomes PoS?” DailyCoin.Com, 5 July 2021, dailycoin.com/what-happens-to-eth-if-it-becomes-pos.</li> | ||

<li>Editorial Staff. “Why Is Ethereum Switching From Proof of Work to Proof of Stake?” Business Magazine - Ideas and News for Entrepreneurs, 15 June 2021, www.businessmagazine.org/why-is-ethereum-switching-from-proof-of-work-to-proof-of-stake-15620.</li> | <li>Editorial Staff. “Why Is Ethereum Switching From Proof of Work to Proof of Stake?” Business Magazine - Ideas and News for Entrepreneurs, 15 June 2021, www.businessmagazine.org/why-is-ethereum-switching-from-proof-of-work-to-proof-of-stake-15620.</li> | ||

| Line 180: | Line 277: | ||

<li>Shivanandhan, Manish. “What Is Sentiment Analysis? A Complete Guide for Beginners.” freeCodeCamp.Org, 30 Sept. 2020, www.freecodecamp.org/news/what-is-sentiment-analysis-a-complete-guide-to-for-beginners.</li> | <li>Shivanandhan, Manish. “What Is Sentiment Analysis? A Complete Guide for Beginners.” freeCodeCamp.Org, 30 Sept. 2020, www.freecodecamp.org/news/what-is-sentiment-analysis-a-complete-guide-to-for-beginners.</li> | ||

<li>“Sentiment Analysis Guide.” MonkeyLearn, monkeylearn.com/sentiment-analysis. Accessed 26 Apr. 2022.</li> | <li>“Sentiment Analysis Guide.” MonkeyLearn, monkeylearn.com/sentiment-analysis. Accessed 26 Apr. 2022.</li> | ||

</ul> | </ul> | ||

Latest revision as of 20:48, 1 May 2022

What is Cryptocurrency?

"Any form of currency that only exists digitally, that usually has no central issuing or regulating authority but instead uses a decentralized system to record transactions and manage the issuance of new units, and that relies on cryptography to prevent counterfeiting and fraudulent transactions". [1] Cryptocurrencies are based on a blockchain technology, also known as a distributed ledger. Due to the decentralised nature, the currencies are thought to be resistant to government manipulation and interference. [2]

Origins of Cryptocurrencies

Bitcoin

Created in 2009, Bitcoin is the first decentralized cryptocurrency that runs on a peer to peer network built on blockchain technology. The creator of bitcoin uses the pseudonym Satoshi Nakamoto, but their real identity is unknown at this time.

Bitcoins are created by a process called “Bitcoin mining”, which essentially means that computers solve algorithms and receive rewards in Bitcoin for their work. This process is used to check and verify transactions on the network. The algorithms are “blocks”, that the computers mine and when the block is completely “mined”, the reward is given.

The first block mined contained the message “The Times Jan/03/2009 Chancellor on brink of second bailout for banks.” This indicates that the cryptocurrency was most probably created as a response to the failure of conventional currencies during the 2008 crisis and to give people control over their own money, rather than having to trust a third party like a bank.[3]

Ethereum

If Bitcoin is the mother of all cryptocurrencies, we can call Ether the father. As the cryptocurrency with the second largest market cap, Ether was developed and is the native currency of Ethereum blockchain, which was developed to be able to offer a wider array of implementations and adaptations of blockchain than Bitcoin. It allows anyone to build decentralized applications on top of the Ethereum blockchain, as well as construction and trade of NFT’s, and overall has a more open and adaptable to change environment than Bitcoin, according to most( except Bitcoin maximalists, who think this is just a misconception and a lack of awareness about the real potential of Bitcoin)

Proof of Work vs Proof of Stake

When it was first developed, the security of Ethereum blockchain was based on proof-of-work.This concept is relied upon to make any sort of attack and manipulation on the chain extremely difficult, which is needed to ensure the availability of the network, as well as to prevent mishaps like double spending

Proof of Work

Even though proof of work is a term popularized by Bitcoin(whose security is also based on this concept), it was actually coined in the early 2000s. Later as it got adapted as the security guarantee of most cryptocurrencies, it started to play a more important role in most tech savvy consumers’ lives. To understand how proof of work works, we first need to understand what the “work” in “proof of work” is. Here, work refers to the work done by Etherum miners to validate and add a new block to the blockchain, in order to enable new transactions to take place. Network security relies on the fact that the computations done by the miners in order to add a new block to the chain are very labor-intensive and hard to replicate, yet they are extremely easy to be verified by anyone who wishes to do so.Miners are incentivised by a monetary price in the form of blockchain’s native token, which is given to whoever is able to solve the problem(find the nonce of the transaction) first. However this computationally intensive process also means miners employ very powerful equipment that consumes high amounts of energy. A single Etherum transaction is said to use 262 kWh energy, which is comparable to the amount used by a US household in 5 days. There are many different reasons for the switch from Proof of Work to Proof of Stake, but some of the most common are listed below.

The environmental cost

As mentioned above, the environmental cost of mining seems high to many people, though usually this is not based on a decision made by comparing ETH mining process to other financial transactions, some a lot more meaningless, like high frequency stock trading executed every day in Wall Street. Yet regardless of how fair or an unfair comparison is made, it is obviously a good idea to make sure the future of finance is constructed in a more sustainable way. Hence this is one of the aims of switching from PoW to PoS, which will remove the incentive for doing the calculations necessary to add new blocks to the chain as fast as possible, thus in effect lowering energy consumption of miners[4]

Monopolization of the Network

As mentioned above, the safety and longevity of Ethereum blockchain depends on solving the computational puzzles presented with every transaction as fast as possible. And in order to make sure there are people willing to do this job so that the chain remains online, a monetary incentive is presented to solvers. This financial gain quickly drew the attention of entrepreneurs, especially people who had access to cheap electricity. Slowly, a whole industry developed around Ethereum mining, and the imbalance in computational power of miners meant small-time miners began seeing considerable decreases in their rewards. Eventually, big companies took over almost all of the mining, leading to a highly un-decentralized system, which goes contrary to the very spirit of the development of most blockchain technologies, With a switch to PoS, the hope is a shift to a more egalitarian system where not only mining-whales but also small shrimp who just want to partake in the blockchain have some say will be achieved.[5]

Proof of Stake

Proof of stake is a consensus mechanism where the miners, who are now called “validators” are chosen randomly by an algorithm-though it is important to note that this algorithm makes its selection based on the amount of holdings every validator has, so whoever has more ETH has a higher chance of being picked, currently this bar is set at 32 ETH, which is worth around $100,000 at the time of writing, thus removing the need to compete against other validators and getting rid of the need to employ very fast machines that consume exorbitant amounts of energy.The switch is also supposed to make Ethereum blockchain more scalable, allegedly allowing for up to 100,000 times more transactions to be validated per second.

Monero