Decentralized Finance: present and future

What is Cryptocurrency?

"Any form of currency that only exists digitally, that usually has no central issuing or regulating authority but instead uses a decentralized system to record transactions and manage the issuance of new units, and that relies on cryptography to prevent counterfeiting and fraudulent transactions". [1] Cryptocurrencies are based on a blockchain technology, also known as a distributed ledger. Due to the decentralised nature, the currencies are thought to be resistant to government manipulation and interference. [2]

Origins of Cryptocurrencies

Bitcoin

Etherium

Monero

Stability of Cryptocurrency

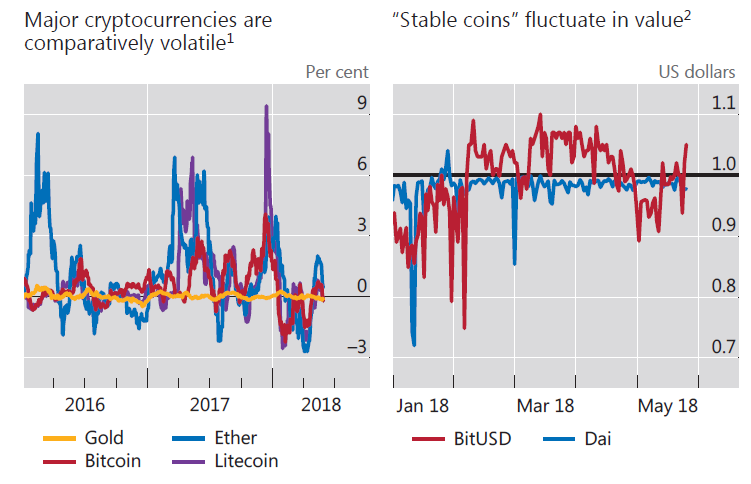

When we talk about the stability of traditional currency, we are referring to the so-called purchasing power of that currency. If the amount of goods that can be purchased with a unit of currency does not fluctuate much over time, then that currency is said to be stable. Before 1971, the value of currency (and its consequent stability) was tightly linked to gold, insofar as the currency was merely a standby for the literal amount of gold that could be exchanged for that banknote of coin. The power of this transition from amounts of stuff (goods, cattle, gold, ect.) to a “paper” that guaranteed the same values exchanged was understood and already implemented in early-developing banking systems. The advantage is clear: less need to move goods around for every transaction; faster and more agile trading. This whole system relies, however, on the possibility of banks to exchange the banknote for gold, and vice versa. The bank grants for the amount of gold in your stead. After 1971, however, the literal connection (and possible exchange) from banknote to gold was severed. Traditional currency is now referred to as fiat (latin for “it will be”). This fiat currency is now issued by a central government, and the same government grants for its value. When managed by strong governments, fiat currency is generally stable. Moreover, governments generally offer some form of asset protection, and enact laws that protect consumers against digital fraud or theft, which makes it easier to recover lost funds. Unfortunately, the centralisation also brings many problems, an obvious one being inflation. Moreover, having to rely on intermediaries, significant charges are issued to users. Absence of intermediaries is indeed one of the more appealing characteristics of crypto currencies, which enables the consumers to lower the fees (transactions, ect.) and costs of account maintenance, and take more control over their finances and privacy. However, the same anonymity properties can attract money launderers and other criminals, who can use them not to be tracked back to a fraud or a cyber attack. These are all factors that contribute in an indirect manner to the stability of crypto currencies; however, the lack of a regulated body that can grant asset protection or insurance is the main cause of instability. The value of cryptocurrency is generally derived from the continued willingness of market participants to exchange fiat for cryptocurrency, which may result in the permanent and total loss of value of a particular cryptocurrency should the market for that cryptocurrency diminish or disappear. There is no assurance that persons and companies who accept cryptocurrency as payment today will continue to do so in the future. Moreover, cryptocurrencies issued with a fixed number of units may be susceptible to deflation. In 2018, the Bank for International Settlements, a 90-year-old institution based in Switzerland, issued a research report concluding that cryptocurrencies are afflicted with inherent contradictions that make their widespread use as money impossible. Most of the crypto currencies generate trust by limiting the amount of currency available, in the case of bitcoin to 21 million. The problem with that is that during periods where there is greater demand for them, the supply is unable to respond This is theoretically a good feature for the store of value function of money, as your savings theoretically cannot be debased by creating more of the currency, but it's not so good for the stability required for price comparisons or making transactions. And it can backfire too for those trying to store value — just as there is no central bank to put downward pressure on the value of money, there's also no institution there to absorb potential losses and prop up the value of cryptocurrencies in times of crisis.

Source: Bank of International Settlements, 2018

Usage During Global Crises

Technology

Limitations

Government & Regulations

Digital Divide

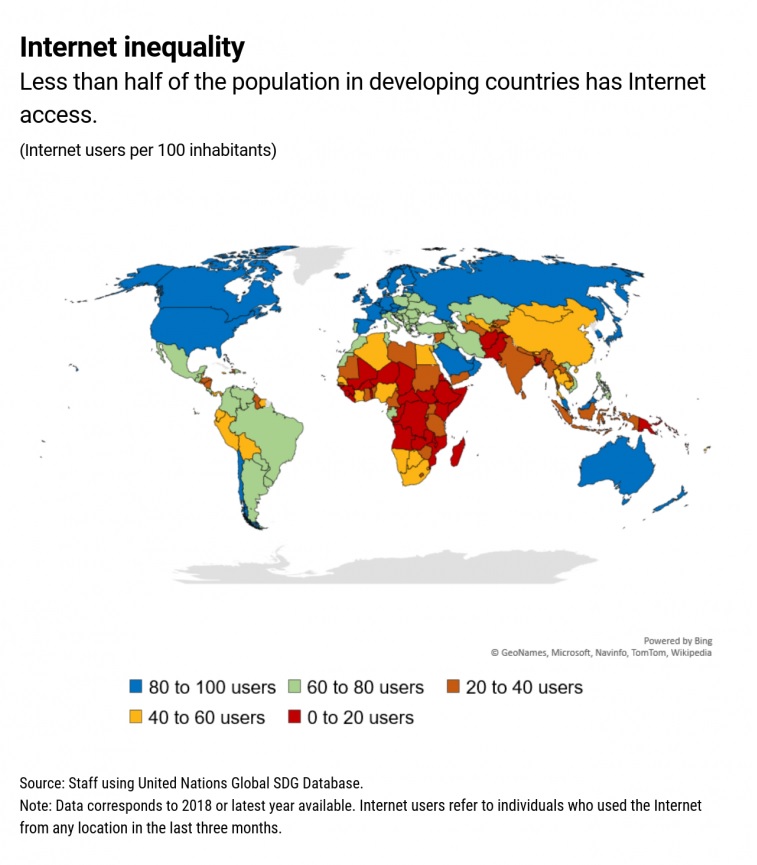

We define the digital divide as the gap between members of society who have access to digital technologies (not only access to the Internet, but also to devices, such as computers and smartphones) and those who do not. The socio-economical disadvantages faced by those who suffer from digital divide are, among others: Learning and researching option are drastically reduced Inability to expand their business reach Limited means to find and apply for jobs Restricted purchasing options, being unable to benefit from the ones that are online Limited way to participate to democratic life, for example through voting According to reports from the United Nations[3] and World Bank[4] almost half of the world still does not have access to the Internet, as per April 2021.Particularly, data showed that, on average, developing countries’ internet penetration rate is around 35% (with the lowest valley recorded in Africa, with only 26%) compared to developed countries of 80%. Moreover, an increase in GDP of about 2 trillion US dollars and the creation of more than 140 million jobs have been estimated to be achieved by raising internet penetration to 75% in developing countries.

Bridging the digital divide by providing mobile networks and internet access would lead to improving the economic growth of a region, and improving social mobility and economic equality.

The two factors that have been hindering the spread of the Internet are: high infrastructure costs to fund rural, remote, or sparsely populated areas and the lack of funding as a result of high infrastructure costs.

As of lately, however, thanks to a promising new iteration of the WiFi technology (namely 6G) combined with a blockchain platform, many companies have expressed interest in venturing into researching and developing solutions for a mesh network that could cover those problematic areas.

A blockchain platform, combined with wireless mesh network technology, can put an end to the digital divide by providing affordable broadband internet access to remote areas.

Source: International Monetary Fund[5], 2020

The specific solution for Africa is a mix of extensive 4G coverage for outdoors and cheap-to-implement WiFi for indoor and stationary users. While it is true that satellite connectivity can be considered as an option for connectivity in remote areas, the costs are still too high, for a pretty slow connection (compared to high speed internet delivered through fiber, for example). the digital divide by bringing the internet via a satellite in a remote area, it is still costly.

A new technology based on blockchain is able to provide the low-cost internet infrastructure much needed in remote areas and low-income countries. Such technology is based on a mesh network architecture which makes use of blockchain protocol to keep track of every node in the network and its usage. Every node can behave as a receiver and a transmitter, essentially covering vast areas as a single Local Area Network with many Access Points.

As subscribers both receive and transmit data to other users, subscribers who consume less data than they transmit can also earn credit. The bookkeeping of this credit is delegated to a dedicated cryptocurrency, through blockchain protocol.

The same cryptocurrency will also be used as a utility credit for the user subscription service. This means that when subscribers pay for the network services they are actually buying a tiny portion of the coin which will be deducted as they use their phone to make calls or surf the internet.

As more and more users use the network the price of the coin will go up. However, this is only going to benefit the subscribers, so if the value of the coin goes up, the amount of available credit also increases.

Regulations

'Pump and Dump' Schemes

Social Intelligence

Future of Cryptocurrency

Environmental Impact

Crypto currencies have been highly criticized for having a very high carbon footprint. Since we are talking about a digital currency, which therefore means it is by definition an “immaterial” commodity, bears the question: how? How can a string of zeros and ones have environmental impact? Everything is connected to the concept of crypto mining, in which “miners” compete to append blocks and mint new currency, each miner experiencing a success probability proportional to the computational effort expended. This form of cryptographic proof in which one party (the prover) proves to others (the verifiers) that a certain amount of a specific computational effort has been expended is called Proof of Work (PoW), and it’s been popularized by Bitcoin. Mining for proof-of-work cryptocurrencies requires enormous amounts of electricity and consequently comes with a large carbon footprint. Proof-of-work (PoW) blockchains such as Bitcoin, Ethereum, Litecoin, and Monero were estimated to have added 3 to 15 Mt (million tonnes) of CO2 emissions to the atmosphere in the period from January 1, 2016 to June 30, 2017. By November 2018, Bitcoin was estimated to have an annual energy consumption of 45.8 TWh (teraWatt-hour), generating 22 to 22.9 Mt of CO2. By the end of 2021, Bitcoin was estimated to produce 65.4 Mt of CO2 and consume between 91 and 177 TWh annually. As of 2022, the Cambridge Centre for Alternative Finance (CCAF) estimates that Bitcoin consumes 131 TWh annually, representing 0.29% of the world's energy production. For what concerns electricity consumption, the world's second-largest cryptocurrency, Ethereum, uses 62.56 kWh per transaction. XRP is currently the world's most energy efficient cryptocurrency, only using 0.0079 kWh of electricity per transaction. Until 2021, according to the CCAF much of Bitcoin mining was done in China. Chinese miners used to rely on cheap coal power in Xinjiang in late autumn, winter and spring, and then migrate to regions with overcapacities in low-cost hydropower, like Sichuan, between May and October. In June 2021 China banned Bitcoin mining and Chinese miners moved to other countries such as the US and Kazakhstan. As of September 2021, according to the New York Times, Bitcoin's use of renewables ranges from 40% to 75%. According to the Bitcoin Mining Council and based on a survey of 32% of the current global bitcoin network, 56% of bitcoin mining came from renewable resources in the second quarter of 2021. Concerns about bitcoin's environmental impact relate bitcoin's energy consumption to carbon emissions. The difficulty of translating the energy consumption into carbon emissions lies in the decentralized nature of Bitcoin, impeding the localization of miners to examine the electricity mix used. The results of recent studies analyzing bitcoin's carbon footprint vary. A 2018 study published in Nature Climate Change by Mora et al. claimed that bitcoin "could alone produce enough CO2 emissions to push warming above 2 °C within less than three decades. However, three other studies also published in Nature Climate Change later dismissed this analysis on account of its poor methodology and false assumptions. For example, one study done by Michael Novogratz's Galaxy Digital claimed that Bitcoin mining used less energy than the traditional banking system. Predictions about bitcoin consuming the entire world's electricity are probably sensationalistic, but it is clear that more specialized research is very much needed, alongside careful monitoring and rigorous analysis. BIS report of 2018 contains a section pertaining to crypto mining and its environmental implications.

Electronic waste

Bitcoins annual e-waste is estimated to be about 30 metric tons as of May 2021. It is also estimated that one Bitcoin generates between 272 and 380 grams of e-waste per transaction. This is worsened by the fact that the average lifespan of Bitcoin mining devices is estimated to be only 1.29 years: the effectiveness of the mining process is tightly linked to having state-of-the-art equipment. Mining hardware is improving at a fast rate, quickly resulting in older generations of hardware being disposed of. To add insult to injury, mining uses application-specific integrated circuits which, unlike most computing hardware, have no alternative use.

Efforts to reduce the impact

Some major cryptocurrencies are implementing technical measures to reduce the negative environmental impact. Bitcoin developers are working on the Lightning Network that would reduce energy demand of the network by moving most transactions off the blockchain. Ethereum is planning a transition from the Proof of Work to the Proof of Stake algorithm. This could reduce the network's energy demand by around 99%. The development of intermittent renewable energy sources, such as wind power and solar power, is challenging because they cause instability in the electrical grid. Several papers concluded that these renewable power stations could use the surplus energy to mine Bitcoin and thereby reduce curtailment, hedge electricity price risk, stabilize the grid, increase the profitability of renewable energy infrastructure, and therefore accelerate transition to sustainable energy and decrease Bitcoin's carbon footprint. Reversible computing chips and hash recycling could possibly provide some advantage to bitcoin mining in forms of reduced energy usage and e-waste, but reversible computing is still at its early stages. More research and development is needed on reversible bitcoin mining chips and also hash recycling for providing entropy to pseudorandom number generation. Climate-related criticism of Bitcoin is primarily based on the network’s absolute carbon emissions, without considering its market value. However, when taking a relative emission perspective that connects Bitcoin’s carbon emissions to its market value, one study suggests that Bitcoin investments can be less carbon-intensive than standard equity investments. The addition of Bitcoin to a diversified equity portfolio can thus reduce the portfolio’s aggregate carbon footprint. A 2022 study concluded that cryptocurrencies and other blockchain applications can support the transition to a circular economy and the underlying three principles of reducing, reusing, and recycling. Cryptocurrencies and token rewards can be used to incentivize the sustainable behavior of individuals. For example, token reward models can incentivize individuals to recycle. There are also several plastic cleanup incentive mechanisms that rely on token rewards.

Data Analysis

- ↑ Cryptocurrency.” Merriam-Webster.com Dictionary, Merriam-Webster, https://www.merriam-webster.com/dictionary/cryptocurrency. Accessed 26 Apr. 2022.

- ↑ Frankenfield, Jake. “What Is Cryptocurrency?” Investopedia, 11 Jan. 2022, www.investopedia.com/terms/c/cryptocurrency.asp. Accessed 21 Apr. 2022.

- ↑ With Almost Half of World’s Population Still Offline, Digital Divide Risks Becoming ‘New Face of Inequality’, Deputy Secretary-General Warns General Assembly. https://www.un.org/press/en/2021/dsgsm1579.doc.htm | 21 Apr 2021. Accessed 26 Apr. 2022

- ↑ Connecting for Inclusion: Broadband Access for All. https://www.worldbank.org/en/topic/digitaldevelopment/brief/connecting-for-inclusion-broadband-access-for-all | Accessed 26 Apr 2022

- ↑ Low Internet Access Driving Inequality. https://blogs.imf.org/2020/06/29/low-internet-access-driving-inequality/ | 29 Jun 2020. Accessed 26 Apr 2022